Forex Trading Vs Other Investments

Forex Trading Vs Other Investments

Blog Article

Day-trading offers many advantages over short-term trading or long-term investing. Usually a day-trader runs out the marketplace at the end of the day, so there is no overnight danger. The day-trader enjoys the marketplace in genuine time, allowing him to change his position live as the market develops. The frequent trades develops his skill much quicker and will help to preserve it at its peak. When they are successful, trades usually have lower danger with smaller losses and there is a quicker return.

Not stopping after a loss is a psychological issue. The moment one gets in the trade he has to choose his loss limitation. It is suitable for you to exit the trade after your trade culminated in a loss. Such sort of psychological decisions to continue the trade might further cause a bigger loss.

When I evaluated what was really happening in the market throughout the day I observed that usually a trend would develop in the early morning and afternoon, which were simpler to trade and earn a profit off of. But throughout the mid-part of the day the volume dropped off considerably and the market tended to form a debt consolidation that was much harder to trade and required more regular trades. It was during this time that the losses dramatically increased.

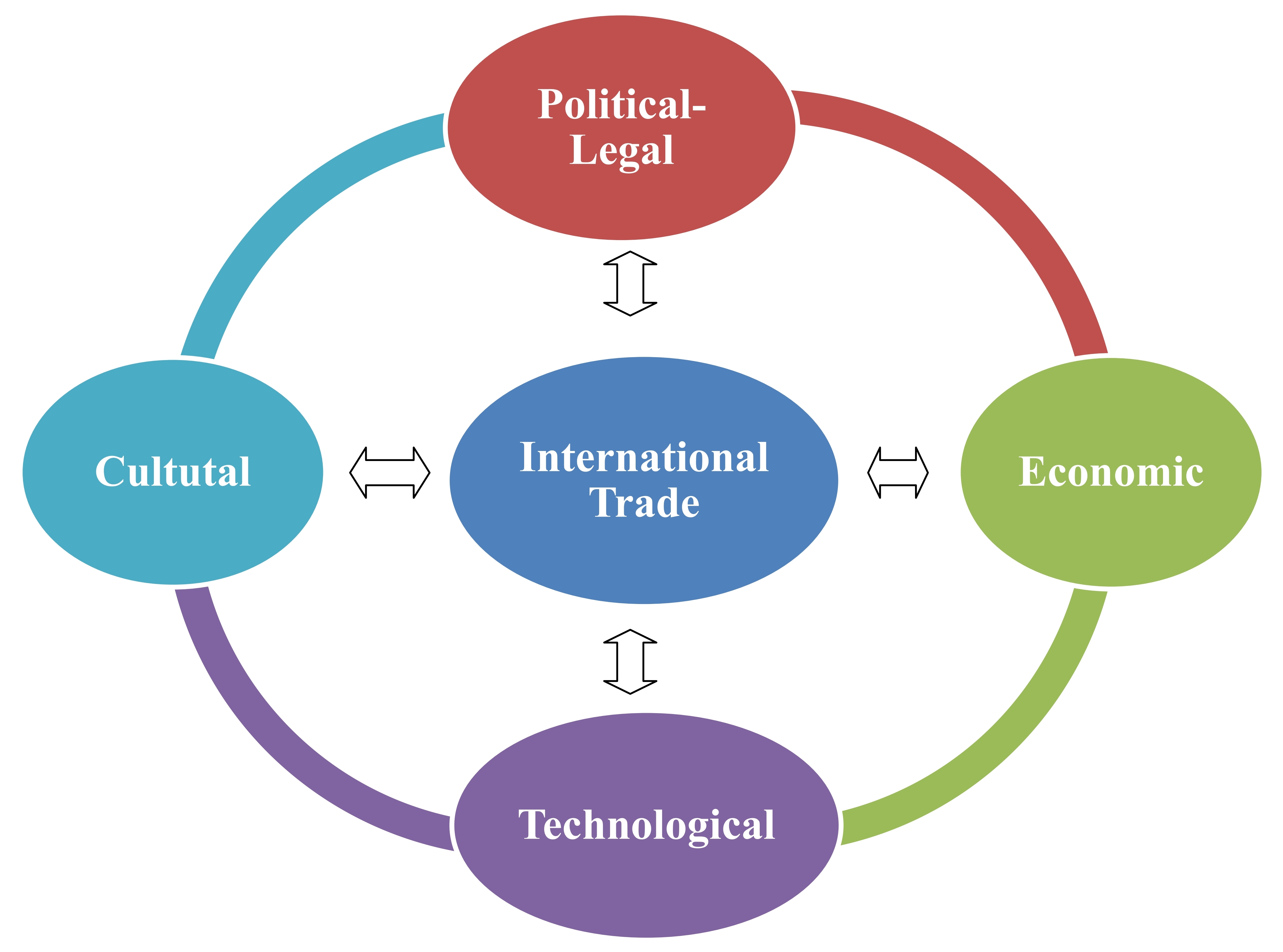

Foreign currency trading is a zero sum game and we as merchants need to attempt to do all the important things International Trade obtainable to get that further advantage over our rivals and swing the opportunities in our favour. Picking among the very best time to commerce the currency pair we have now selected is without doubt one of the important things listed below our management that might just be done.

Well, prior to you begin trading you certainly need to know what is the finest currency set for a beginner. This article will tell you that plus a couple of unusual facts about currencies.

When I reviewed what was actually taking place in the market throughout the day I saw that normally a pattern would establish in the early morning and afternoon, which were simpler to make a revenue and trade off of. But during implications of recent trade the mid-part of the day the volume dropped off significantly and the market tended to form a debt consolidation that was much more difficult to trade and needed more frequent trades. It was during this time that the losses dramatically increased.

Lower Trading Expense: The cost of trade is really low as compared to other products and stock markets. The broking website or a broker does not charge high commission charges.